Confident for any packaging challenge

Whether you want to buy packaging materials now, ask for advice about custom packaging or transform your entire packing operation, our experts are on hand.

This form is protected by reCAPTCHA - the Google Privacy Policy and Terms of Service apply.

We serve businesses of various sizes, allowing you to find the ideal packaging solutions for your requirements with ease.

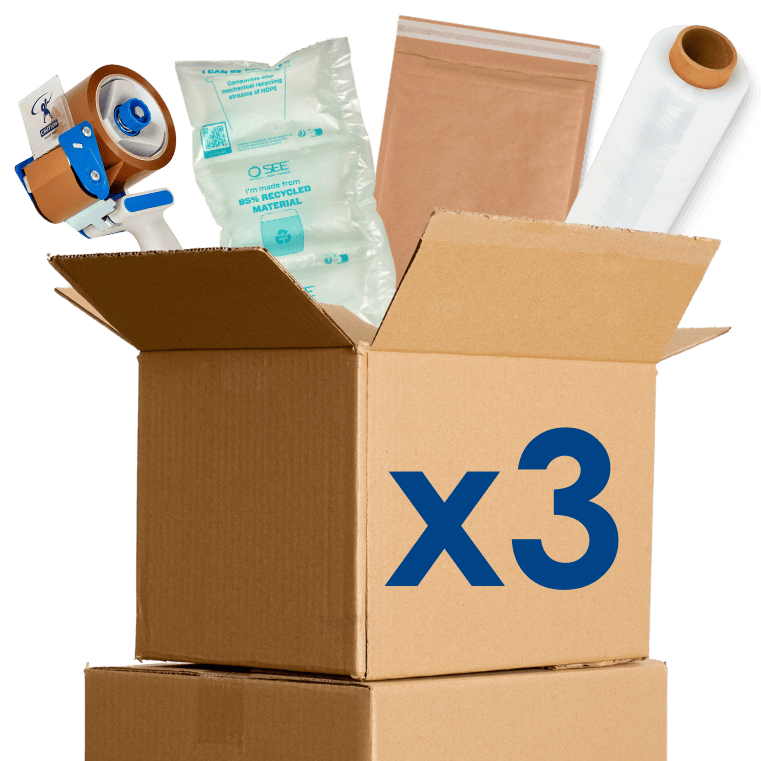

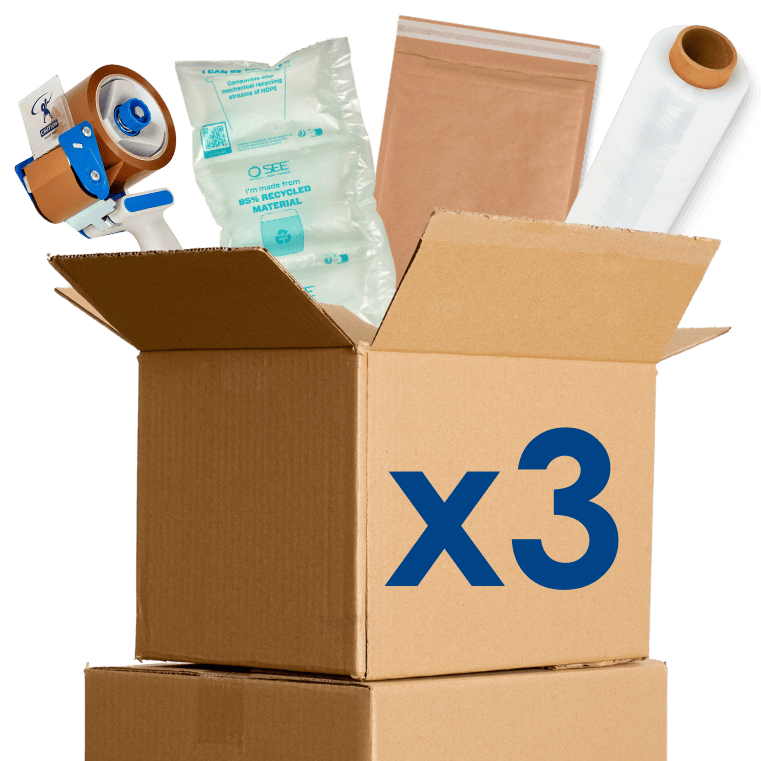

We've tripled our online product range, so you've got 3x more choice when buying packaging online. Free, fast delivery when you spend £150+/€150+ ex VAT.

Expanded product range

More products, more protection, more packaging possibilities

Expanded product range

More products, more protection, more packaging possibilities

We've tripled our online product range, so you've got more choice. Free delivery on orders £150+/€150+ ex VAT.

Use code NEW10 in the UK or NEW10IE in Ireland. Terms and conditions apply.

From bubble wrap, Airsac and air bags to paper void fill, foam rolls and packing peanuts, we have a huge range of protective packaging to safeguard your products.

New EPR legislation is expected to cost UK businesses over £2bn...

New EPR legislation is expected to cost UK business over £2bn...

Discover our extensive range of packaging bags. From mailing bags and bubble envelopes to grip seal bags, carrier bags and polythene bags, there's a bag for everyone.

And not just the cost of the packaging itself, Macfarlane Packaging can consider all the costs associated with your packaging operation.

Protective packaging products and services to businesses throughout the UK, Ireland and Europe

Speak to one of our packaging specialist online, by email or by phone.

Call 0800 2 88 88 22 in the UK or

+353 (404) 37370 from Ireland during business hours.

Protective packaging products and services to businesses throughout the UK, Ireland and Europe

Whether you want to buy packaging materials now, ask for advice about custom packaging or transform your entire packing operation, our experts are on hand.